Heavy Long-Term Volume in Arista Networks Call Options - Investors are Bullish

/Arista%20Networks%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Heavy, unusual volume in long-dated, out-of-the-money call options of Arista Networks (ANET) signals investors' bullish sentiment. ANET stock is up over +17% today after its Q2 earnings release yesterday. Should investors copy this trade?

ANET is at $138.76, up +17.5% from $118.12 yesterday, and up from a recent low of $86.25 on June 20.

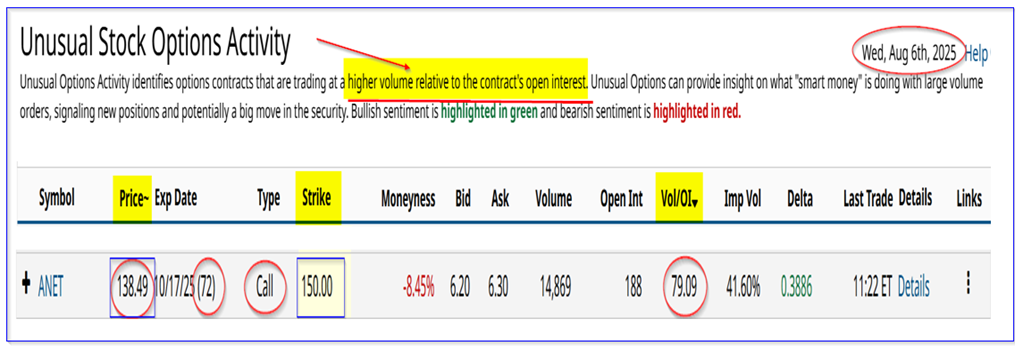

The unusual call options activity can be seen in today's Barchart Unusual Stock Options Activity Report. It shows that almost 15,000 call options contracts have traded at the $150 strike price expiring Oct. 17, 2025, which is 72 days from now.

That $150 strike price is out-of-the-money (OTM) since it's +8.37% over today's elevated price. This is a very bullish signal from long-term buyers of these call options.

The heavy volume of call options is over 79 times the prior number of call options outstanding. That means an institutional investor has taken a huge position.

Let's look at why they are so bullish on the ANET stock.

Strong Earnings and Free Cash Flow (FCF) Results

Arista Networks provides data center and cloud networking software products for financial, technology, and data-driven solutions providers. It's directly benefiting from the huge amount of capital being spent on artificial intelligence (AI) driven investments by many tech companies.

That can be seen in its latest results released on Aug. 6. For example, Q2 revenue was up +10% Q/Q to $2.2 billion and up +30% Y/Y. In addition, its 6-month revenue is up +29% Y/Y to $4.21 billion.

This revenue was significantly higher than analysts' expectations of $2.11 billion - i.e., an upward surprise of +4.3%. Analysts are likely to increase their revenue forecasts. That could be one reason why ANET stock is up so much.

Another reason is that Arista Networks is also very profitable. For example, its Q2 operating income of $1.08 billion represents 49% of its $2.2 billion in revenue. Moreover, its operating cash flow (OCF) for the six months was 43.7% of the $4.21 billion in revenue.

Since ANET has very little capex spending (just $52.4 million for the six months), its free cash flow (FCF) of $1.79 billion represents 42.5% of 6-mo sales. This could push FCF forecasts higher.

Higher FCF Forecasts and Price Targets

Analysts surveyed by Seeking Alpha are projecting $8.42 billion in revenue for 2025 and $9.95 billion for 2026, a Y/Y gain of +17.6%. Yahoo! Finance says analysts have an even higher 2026 forecast of $10.31 billion.

I suspect that after today's +4.3% revenue surprise, analysts will likely increase their revenue forecasts. As a result, we can project around $10.7 billion for 2026.

That means that the next 12 months (NTM) revenue will average around $9.56 billion. Applying a 43.7% OCF margin, and assuming capex rises 10% to $115 million (i.e., $52.4m x 2 x 1.1), here is the FCF forecast:

$9.56 billion x 0.437 = $4.178 billion OCF

$4.178 b - $0.1150 capex = $4.063 billion FCF

That $4.06 billion FCF is +13.5% higher than the projected $3.58 billion run rate FCF for 2025 (assuming the first half $1.79 billion FCF doubles).

That could push ANET stock's value higher. For example, using a 2.0% FCF yield metric (i.e., 50x FCF), the market cap could rise over $203 billion from $174 billion today:

$4.063b FCF / 0.02 = $203.15 billion

$203.15b / $173.87 b mkt cap today = 1.1684 -1 = +16.8% upside

That sets the price target for ANET at $162.00 per share (i.e., $138.76 x 1.168).

That could be why investors are so bullish on ANET stock.

How the Call Options Play Works

The $150 strike price calls have a midprice premium of $6.25 per call contract. That sets the breakeven price at $156.25. This is below the expected price target of $162 and the call option is likely to be profitable.

For example, let's say that in two months ANET stock has risen to $160. The $150 strike price call option is likely to trade for more than the instrinsic value of $10 (i.e., $160-$150). It could have some $2 or $3 in extrinsic value, so the call option premium would be $12 or $13.00.

So, the investor who bought in at $6.25 could double their money (i.e., $12.50/$6.25 = 2) in just 2 months.

That could account for the heavy volume in today's call options due in 2.5 months on Oct. 17. In other words, the investors believe that the target price will be reached in over 2 months.

However, that has a huge amount of risk. Keep in mind our target price is based on the next 12 months (NTM) revenue and FCF projections. The market may not yet come to see this in two months.

Therefore, investors should be careful in following institutional investors in this call option play. They can study Barchart's Options Learning Center tabs to better understand the risks with call options.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.